$ : chr "DC.Open" "DC.High" "DC.Low" "DC.Close". Ģ.1 Extract one column from one instrument # Load dataĭC <- read.csv("~/resources/rstudio/DC.csv")ĭC$Date <- as.POSIXct(DC$Date, format("%Y-%m-%d %H:%M:%S")) $ : chr "JNJ.Open" "JNJ.High" "JNJ.Low" "JNJ.Close".

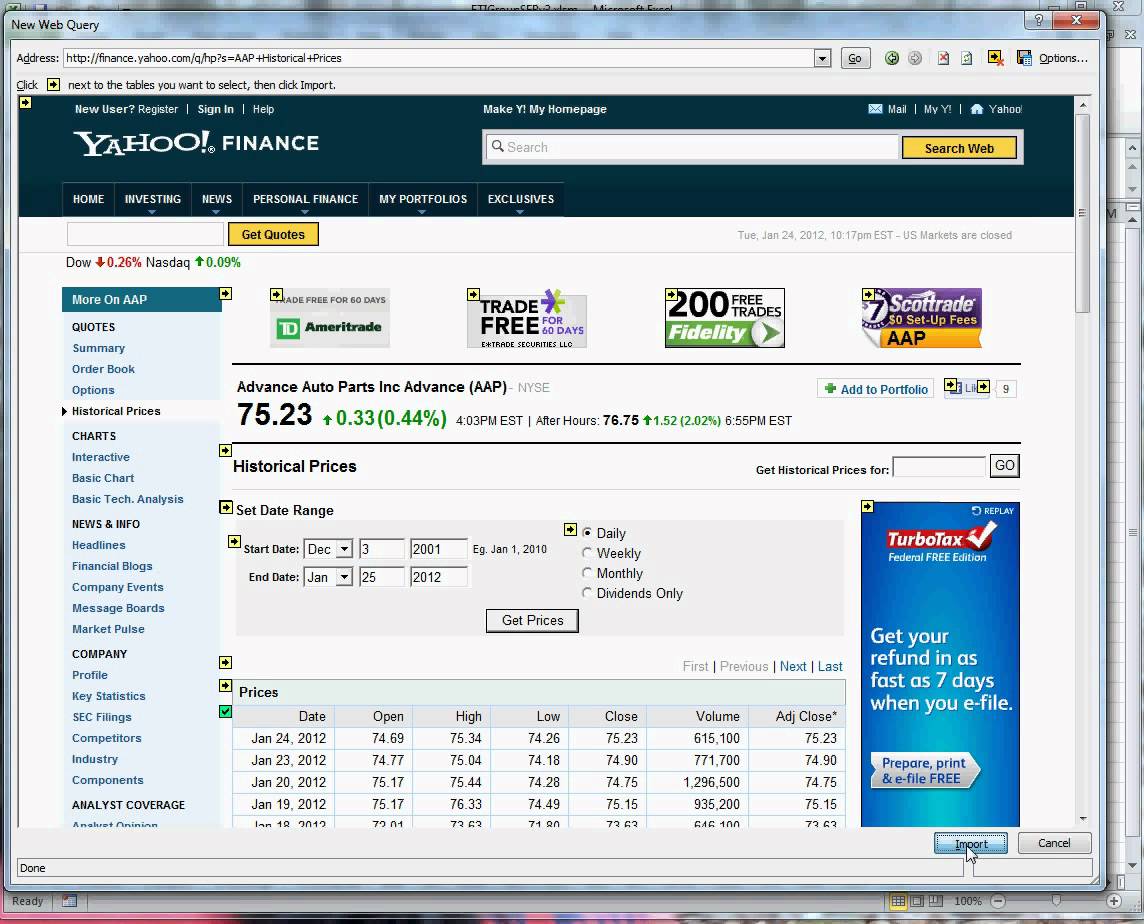

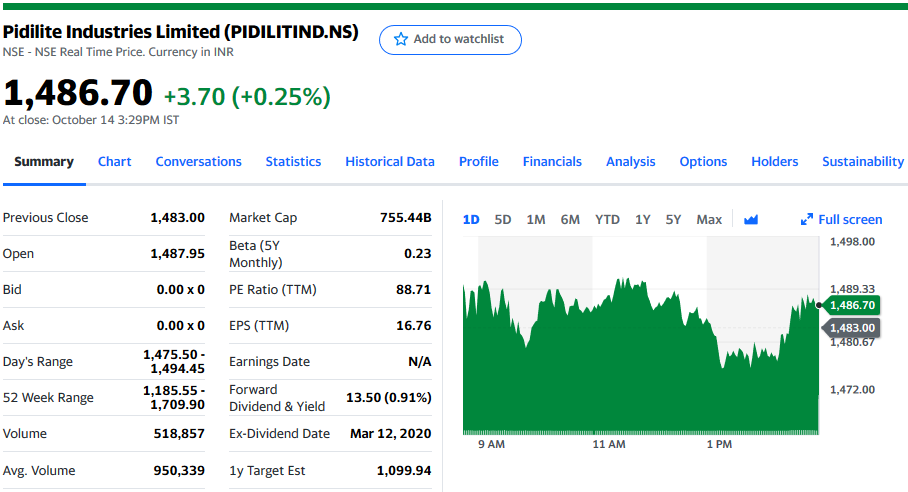

# Look at the structure of the 'jnj' object Jnj <- getSymbols(Symbols = "JNJ", env = NULL) # Assign JNJ data to object named 'jnj' using env argument $ : chr "SPY.Open" "SPY.High" "SPY.Low" "SPY.Close". # Look at the structure of the 'spy' object Spy <- getSymbols(Symbols = "SPY", auto.assign = FALSE) # Assign SPY data to object named 'spy' using auto.assign argument # QQQ.Open QQQ.High QQQ.Low QQQ.Close QQQ.Volume QQQ.Adjusted $ : chr "QQQ.Open" "QQQ.High" "QQQ.Low" "QQQ.Close". # Look at the structure of the object getSymbols created GetSymbols(Symbols = "QQQ", auto_assign = TRUE) exchange rate, US Dollar per South Korean Won (for the past 180 days) Retrieve the data for the period between -31, using the packages and functions you learned in this course.2.6 Use quantmod to download multiple instruments and extract the close column.2.5 Combine objects from an environment using do.call and eapply.

2.4 Use Quandl to download weekly returns data.2.3 Use getPrice to extract other columns.2.2 Extract multiple columns from one instrument.2.1 Extract one column from one instrument.

Chapter 2: Extracting and transforming data.1.8 Find and download US Civilian Unemployment Rate data from FRED.1.7 Download exchange rate data from Oanda.1.6 Find stock ticker from Google Finance.1.3 Make getSymbols() return the data it retrieves.Chapter 1: Introduction and downloading data.Importing and Managing Financial Data in R.

0 kommentar(er)

0 kommentar(er)